Step 1: Understand Why Average Deal Size Matters

Imagine this: your team closes 10 new deals this month. That sounds great, right? But if the average deal is worth only $500, your revenue is $5,000. If the average deal is worth $5,000, the same 10 deals bring in $50,000.

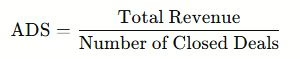

That’s why Average Deal Size (ADS) is such a powerful metric. It doesn’t just count deals—it measures their impact. Knowing your ADS enables you to forecast revenue, balance your pipeline, and determine where your sales team should allocate their time.

Step 2: Calculate Your Average Deal Size

The formula is straightforward:

📌 Example: If you generated $120,000 from 40 deals last quarter, your ADS is $3,000.

This number becomes your benchmark. Every strategy you test—new packages, pricing changes, or contract terms—should aim to shift this benchmark upward.

Step 3: Compare Your ADS to Industry Benchmarks

Average deal sizes vary widely across industries. A consulting firm will always have bigger contracts than an eCommerce shop. Here’s a quick snapshot:

| Industry | Typical ADS Range | Sales Cycle Length | Notes |

|---|---|---|---|

| SaaS (B2B) | $3,000 – $20,000 | 1–3 months | Larger ADS tied to annual contracts |

| Consulting | $15,000 – $150,000 | 3–9 months | High-value, relationship-driven deals |

| eCommerce (B2C) | $50 – $500 | Immediate | Focus on volume, not deal size |

| Real Estate | $50,000 – $500,000+ | 2–12 months | Wide variation by market |

| Manufacturing | $30,000 – $250,000 | 6–18 months | Complex, often multi-party decisions |

👉 Tip: Don’t judge your ADS without context. Compare it with competitors in your space, not with businesses in completely different industries.

Step 4: Strategies to Grow Your Average Deal Size

Now that you know where you stand, the question is: how do you move the needle? Here are tested approaches I’ve seen work in practice:

-

Bundle products or services: Instead of selling one item, package a group that solves a bigger problem.

-

Encourage longer contracts: Annual agreements not only raise ADS but also stabilize cash flow.

-

Train your sales team: Great negotiators close larger deals because they frame value effectively.

-

Target high-value clients: Sometimes, fewer clients at a higher ADS outperform chasing volume.

One client I worked with shifted from monthly contracts to annual plans and saw their ADS jump by 40%—without adding new customers.

Step 5: Balance Deal Size and Sales Cycle

A bigger deal almost always means a longer sales cycle. That’s not a bad thing, but it’s something you need to manage. Smaller deals keep your team busy and bring in fast revenue, while larger ones build long-term growth.

The healthiest pipelines have both: small wins that sustain cash flow, and big wins that transform the business.

Final Thoughts

Average Deal Size is more than just a metric—it’s a mirror. It shows whether your strategy, pricing, and sales focus are aligned with your growth goals.

The good news? You don’t need to double your customer base to double your revenue. Sometimes, raising your ADS by just 20% has the same effect.

Think of it this way: closing smarter deals is often more valuable than closing more deals.